How to Create Filing Status & Federal Tax Brackets in Horilla Free Payroll Software

In today’s business landscape, precise payroll processing is paramount for compliance and employee trust. Horilla, through its operational efficiency, introduces a transformative solution—Filing Status and Federal Tax Brackets.

Filing Status categorizes employees based on marital and dependent criteria, ensuring accurate tax calculations.

In complementarity, Federal Tax Brackets determine rates aligned with income, promoting fairness.

This union revolutionizes payroll management, reflecting our commitment to efficiency and accurate earnings for employees.

Explore the capabilities of Filing Status and Federal Tax Brackets on our Open Source Payroll Management Software at Horilla, where we offer these tools to streamline payroll processes.

Filing Status

Imagine Filing Status as a canvas where an employee’s tax identity is painted. It captures essential details—marital status, dependents, and more. This mosaic lets businesses categorize employees based on their unique tax situations. With choices like ‘Single,’ ‘Married,’ or ‘Head of Household,’ employers tailor tax calculations for compliance and accuracy. Filing Status isn’t just a checkbox; it’s the foundation for precise tax withholdings aligned with individual scenarios.

Federal Tax Brackets

Embedded within Filing Status, Federal Tax Brackets bring a scientific approach to taxation. These brackets define income thresholds, each with an applicable tax rate. Picture them as finely tuned tax zones. When an employee’s income fits a bracket, the corresponding tax rate is applied. This meticulous system ensures accurate tax calculations, moving away from a one-size-fits-all approach. Federal Tax Brackets create an intricate yet equitable payroll ecosystem. And all of this is seamlessly integrated into our very own Horilla project.

Step-1 Creating Filing Status

To create a new filing status and set up tax brackets using Horilla’s free payroll management software, follow these steps:

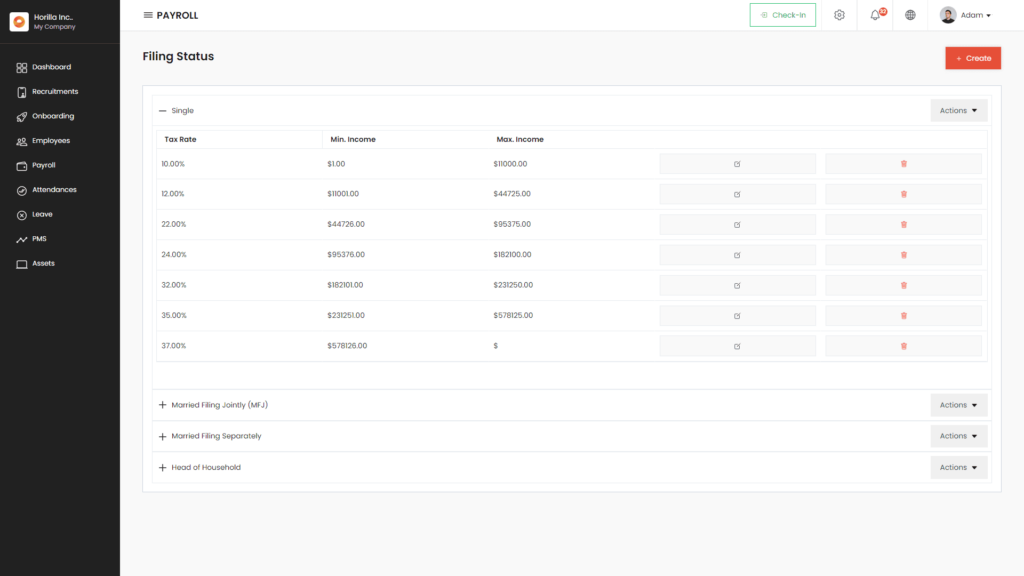

Begin by logging into your Horilla account. Next, access the “Payroll” menu from the sidebar. Within the Payroll menu, find and click on “Federal Tax” to enter the Filing Status and Tax Brackets page.

On this page, you’ll find a list displaying existing filing statuses and their corresponding tax brackets. To explore the details of each filing status, click on the respective filing status entry, which will reveal the specific tax brackets linked to that particular filing status. Locate the “Create” button situated in the upper-right corner.

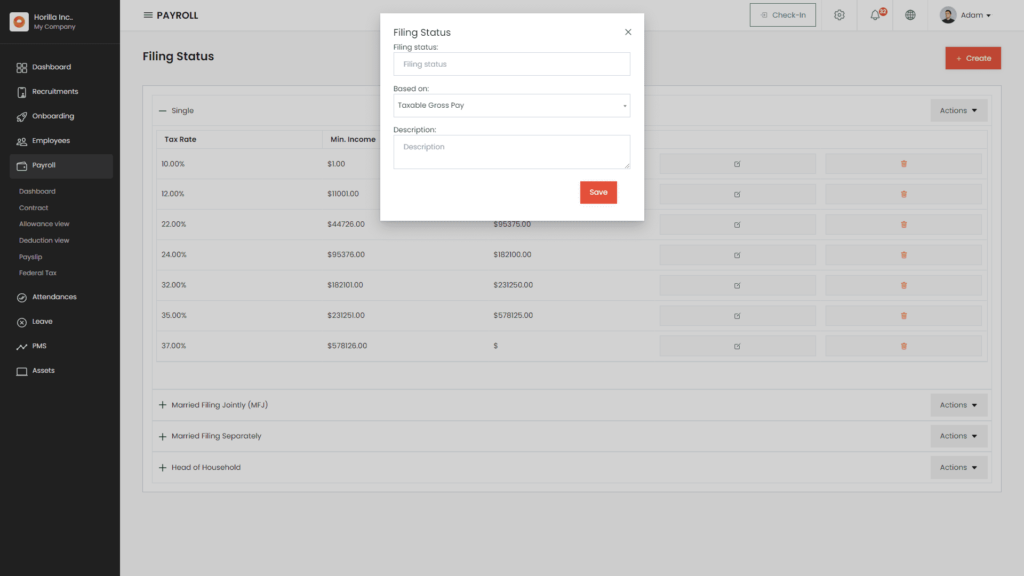

Clicking the “Create” button will bring up a form where you can input the necessary details for creating a filing status.

Filing status

Enter a descriptive name for the filing status. This is the name that will be displayed in the list and the contract creation form.

Based on(Select field)

Select from the available options the basis for tax calculation. This can be based on basic pay, gross pay, or taxable gross pay.

Description(Optional)

If needed, add a description that explains more about this filing status.

After entering all the required information, click on the “Save” button to create the new filing status. Once saved, you should receive a confirmation message. The newly created filing status will now be available for creating tax brackets.

Step-2 Creating Federal Tax

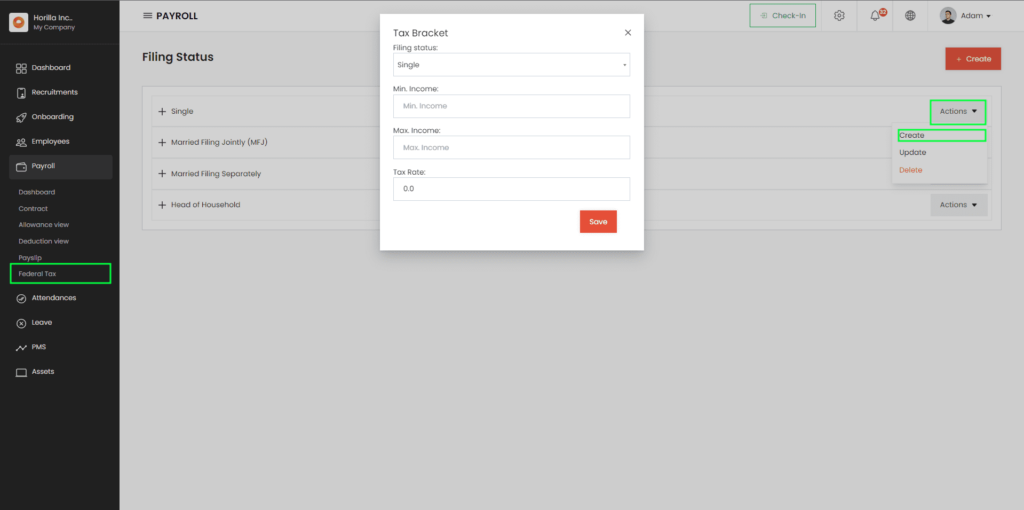

Identify the filing status under which you want to configure federal tax settings. Locate the corresponding entry within the list. In the same row as the chosen filing status, you’ll find an “Action” label. Click on this button to reveal a dropdown or menu of available actions related to the filing status. Among the actions listed, look for the option labeled “Create.” Select this option to initiate the process of creating a tax bracket for the selected filing status.

Filing status (select field)

Select the filing status associated with this tax bracket, helping to categorize the taxation rules. The options are prefilled based on the filing status “Action” button clicked.

Min. Income

Enter the minimum income threshold for this tax bracket, defining the starting point for applying the tax rate. Ensure a non-empty, valid numerical value is provided and minimum income greater than the maximum income of any existing tax brackets under the filing status.

Max. Income

Enter the maximum income threshold for this tax bracket. Leave this field empty if there’s no upper limit. Ensure the entered value, if provided, is greater than the minimum income and is a valid numerical value.

Tax Rate

Specify the tax rate applicable within this income range. Ensure a non-empty, valid numerical value is provided as the tax rate.

After completing the form, click the ‘Save’ button to generate the tax bracket with the entered details under the filing status. To close the form, simply click on the close icon (represented by an ‘X’) located within the top-right corner of the form window. After closing the form, the page will refresh, and you can view the newly created tax bracket by clicking on the specified filing status.

To read more about choosing the right HRMS payroll system for your business, refer to our blog How to Choose the Right HRMS Payroll System for Your Business

Conclusion

Horilla Free HR Software simplifies the process of creating filing statuses and tax bracket, making it easy for business to manage their payroll efficiently. By assigning the appropriate filing status to each employee when creating their contract, you can ensure that their taxes are calculated accurately, which is crucial for their financial well-being and your company’s compliance.

Explore the capabilities of Filing Status and Federal Tax Brackets on the Horilla Open Source HR Software to streamline your payroll processes and ensure that your employees receive the precise earnings they deserve. Horilla’s commitment to efficiency and accuracy in payroll management reflects its dedication to helping businesses thrive in today’s dynamic landscape.